You could also use a cash progress app with 0% curiosity, although they sometimes demand a regular membership and charges for fast transfers.

Make sure you Take note that by clicking Carry on below, you can depart Lendly, LLC’s Web site. Lendly, LLC does not individual or operate this Web-site and therefore cannot make sure its content.

Areas Financial institution presents exact-working day loan funding for current customers, which makes it a superb decision if you want funds in a very hurry. Whether you’re coping with a professional medical bill or vehicle repairs, Regions can offer emergency money with flexible loan amounts.

The quick funding and dependable customer service enable it to be a reliable alternative when you’re already banking with copyright and facing an urgent monetary have to have.

All of our information is authored by highly skilled specialists and edited by subject material professionals, who be certain all the things we publish is aim, exact and trustworthy. Our loans reporters and editors center on the details shoppers treatment about most — the different types of lending possibilities, the very best costs, the best lenders, the best way to pay off financial debt plus much more — so you can really feel assured when investing your cash.

But this payment isn't going to influence the data we publish, or perhaps the evaluations that you simply see on this site. We don't consist of the universe of companies or financial features That could be available to you.

Think about Checking out debt reduction alternatives, such as consolidation or credit rating counseling, to stay away from default, which can damage your credit and result in legal motion. If desired, find support from authorities courses or nearby nonprofits to go over important charges.

Negatives Hefty borrowing charges: Lender fees as well as curiosity chances are you'll fork out on these loans could make them a pricey source of funding. Potentially addictive: The convenience of accessibility and rapid funding situations place you at risk of regularly relying on revenue-borrowing apps when cash move troubles arise. Fails to handle serious budgeting difficulties: A cash-borrowing application could quickly remedy a far more serious problem with the price range and expending behavior. How to match funds-borrowing apps

Service fees and Penalties: Some lenders will charge loan origination expenses, late payment service fees, and in some cases prepayment penalties. Other lenders don’t. Be sure you know who does therefore you don’t pay additional of your respective tricky-earned funds than you might more info want to.

Bankrate.com is really an impartial, promoting-supported publisher and comparison provider. We're compensated in exchange for placement of sponsored services, or by you clicking on selected back links posted on our web site. As a result, this compensation may well impact how, in which As well as in what purchase goods appear in just listing categories, except the place prohibited by law for our property finance loan, household fairness and various house lending goods.

Universal Credit history, owned by Improve, presents poor to fantastic credit personalized loans with speedy funding once you will need it. Loan quantities begin at a very low $one,000 with repayment terms from three to five years.

Tiny personal loans: Consider modest private loans from online lenders. In the event you’re nervous your credit rating is too lower, some have loan products that cater to borrowers with fewer-than-excellent credit history. You’ll pay out more curiosity, but own loans are frequently capped at 36 p.c.

Contemplate alternatives. Even though poor credit rating loans are an option for individuals with weak credit score, borrowing from your charge card may be cheaper — and there’s no application approach if you have already got a card.

These internet sites like NetCredit give individual loans on the net, settle for negative credit rating and will improve your credit score score. Loans like Upstart

Michael Oliver Then & Now!

Michael Oliver Then & Now! Christina Ricci Then & Now!

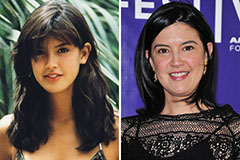

Christina Ricci Then & Now! Phoebe Cates Then & Now!

Phoebe Cates Then & Now! Pauley Perrette Then & Now!

Pauley Perrette Then & Now! Melissa Sue Anderson Then & Now!

Melissa Sue Anderson Then & Now!